do you pay taxes when you sell a used car

You also have to factor the improvements into the equation. You can determine the amount you are about to pay based on the Indiana excise tax table.

Sell Your Car In Cincinnati Oh Subaru Of Kings Automall

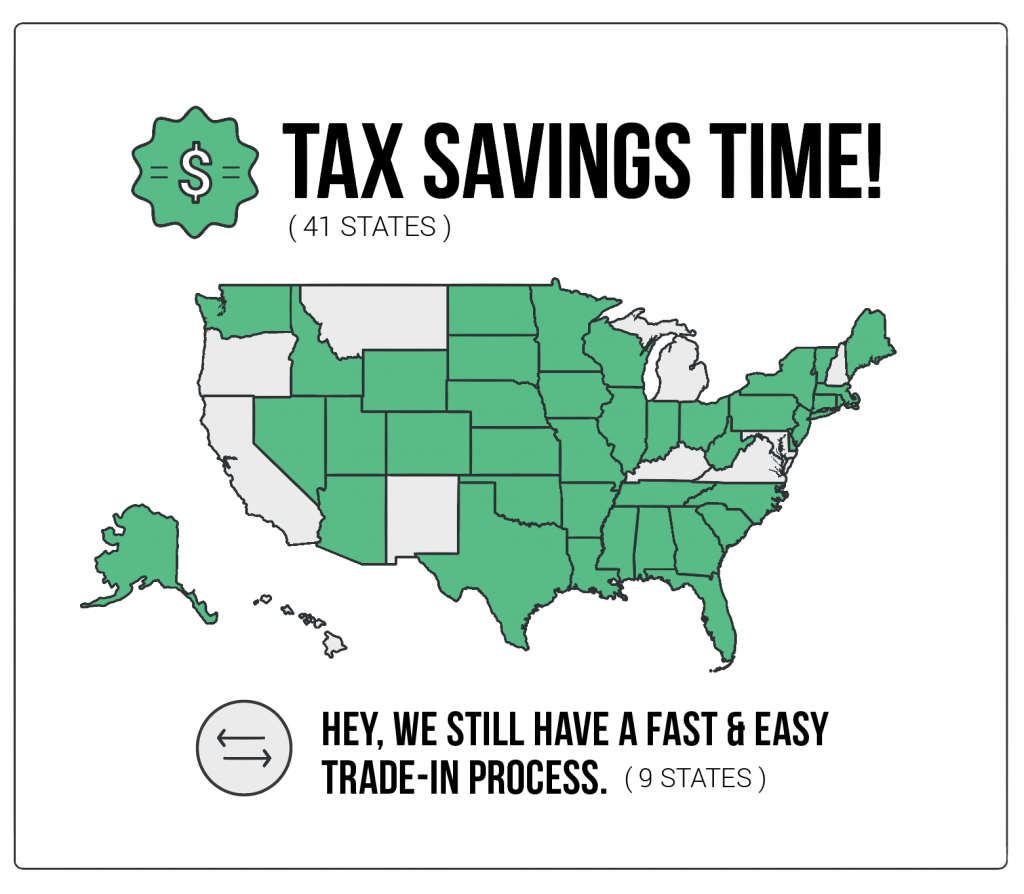

If you buy another car from the dealer at the same time many states offer a trade-in tax exemption that lowers the amount of sales tax youll pay in the trade.

. So if your used vehicle costs 20000. When you trade in a vehicle instead of paying tax on the full value of the new car you are taxed based on the difference in value between the trade-in and the new vehicle. If for example you.

Although a car is considered a capital asset when you originally purchase it both state. The person you are buying the car from will also have a significant part in deciding if we will have to pay taxes on a used car or not. The sale must also be reported to the Missouri Department of Revenue and the seller must complete a notice of sale or bill of sale.

The short answer is maybe. That means youll be taxed only on. For example if you bought the two-year-old SUV for the original retail price of.

You dont have to pay any taxes when you sell a private car. You also want to trade in your old car. Selling a car for more than you have invested in it is considered a capital gain.

In most cases you do not have to pay any taxes when you sell your car to a private seller or a company like The Car Depot. The good news is that you dont need to pay capital gains tax on the difference between the purchase price and the sale price. Iowa collects a 5 state sales tax rate as a One-Time Registration Fee on the purchase of all vehicles.

In addition to taxes car purchases in Iowa may be subject to other fees like. A lien release from a lender if applicable 1. The buyer is responsible for paying the sales tax.

Law info - all about law. Answered by Edmund King AA President. Thankfully the solution to this dilemma is pretty simple.

You do not need to pay sales tax when you are selling the vehicle. Even in the unlikely event that you sell your private car for more than you paid for it special. There are some circumstances where you must pay taxes on a car sale.

If the dealer offers you 25000 for it you now owe the dealer the 20000 balance for the new car. Most people might not know what I want to. Thus you have to pay.

Most car sales involve a vehicle that you bought new and are. Typically most states charge between 5 and 9 for their sales tax says Ronald Montoya senior consumer advice editor at Edmunds. When you sell a car for more than it is worth you do have to pay taxes.

Illinois Imposing Car Trade In Tax On Jan 1 Dealers Call It Double Taxation

Carvana Vs Carmax Who S Better For Buying And Selling Used Cars

Vehicle Sales Tax Deduction H R Block

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

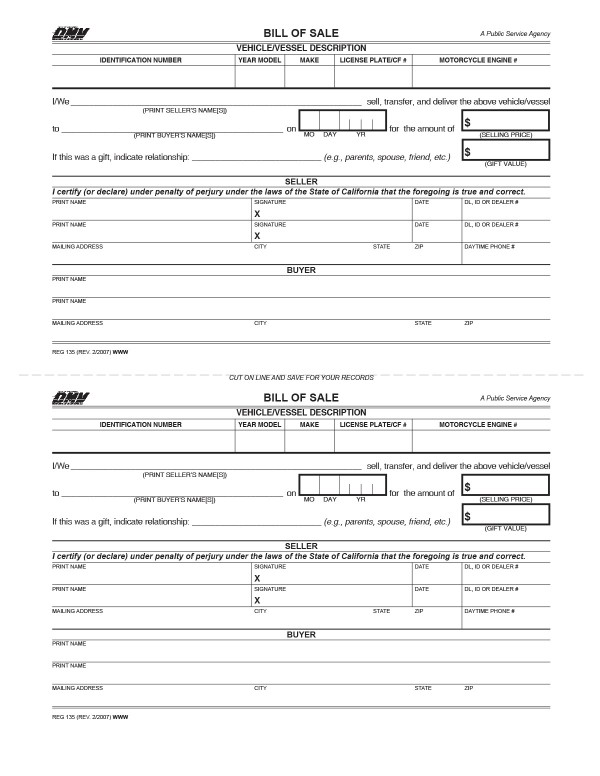

All About Bills Of Sale In California The Facts And Forms You Need

Do You Pay Sales Tax On A Used Car Nerdwallet

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

How Do Tax Deductions Work When Donating A Car Turbotax Tax Tips Videos

Business Use Of Vehicles Turbotax Tax Tips Videos

Free Motor Vehicle Dmv Bill Of Sale Form Word Pdf Eforms

Capital Gains Tax On Real Estate And Selling Your Home In 2022 Bankrate

How Does Selling To A Dealer Work News Cars Com

Buying A New Car Use A Trade In To Get A Sweet Tax Credit In These 41 States By Vroom Vroom

If I Buy A Car In Another State Where Do I Pay Sales Tax

Car Bill Of Sale Pdf Printable Template As Is Bill Of Sale

Car Financing Are Taxes And Fees Included Autotrader

Benefits Of Buying A Used Car With Your Tax Return

What To Know About Taxes When You Sell A Vehicle Carvana Blog

Used Vehicle California Sales Tax And California Board Of Equalization